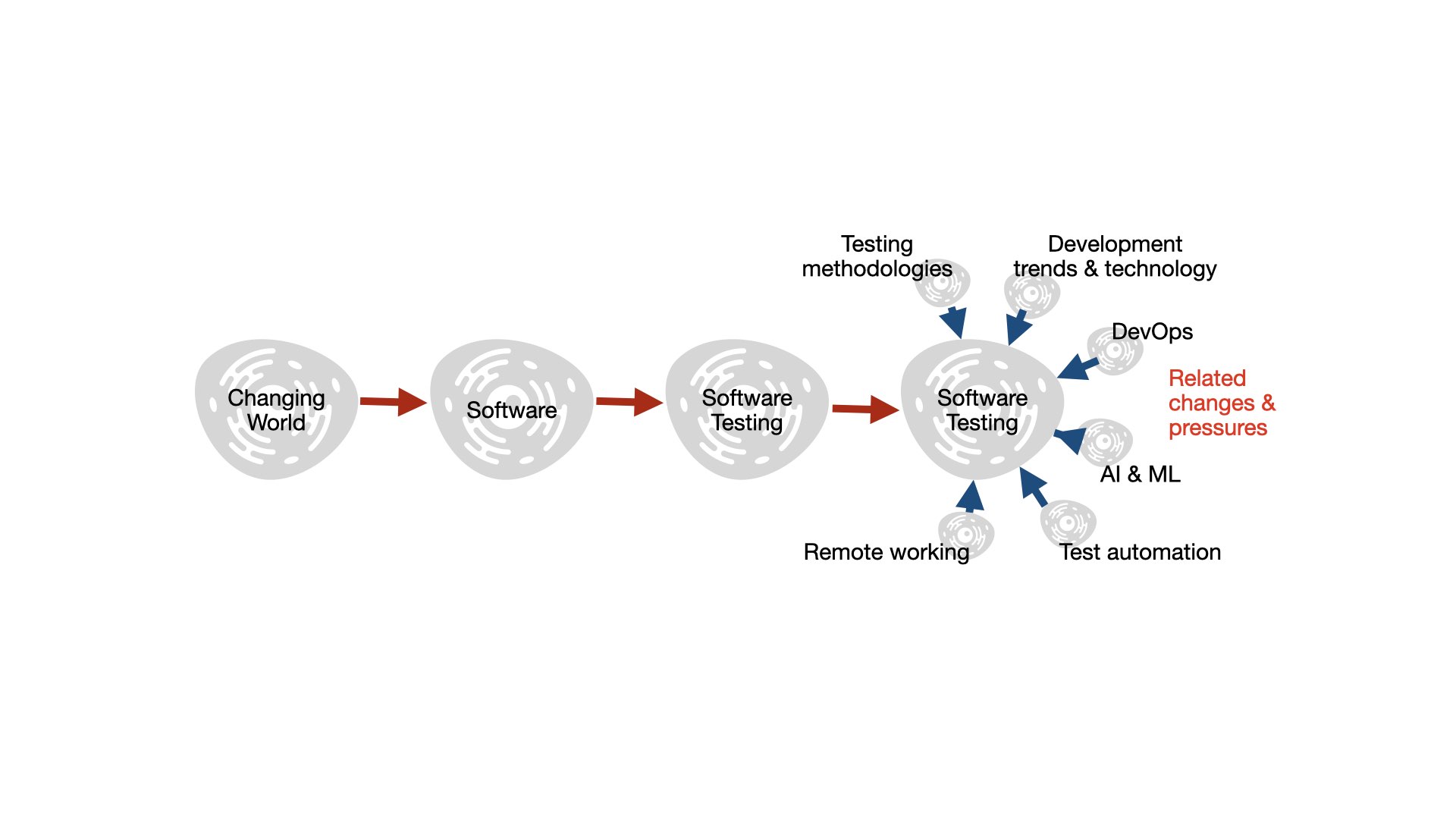

In my last entry I had narrowed down my view of the Changing World (insofar as I have modelled it) such that it looked like this:

And what I had established was that in order to meaningfully stay up to speed with changes in the world, you have to place some constraints upon the scope of what you’re going to look at - because otherwise there’s simply too much stuff going on and you’ll be overwhelmed by it all.

So for my purposes, I want to focus primarily on the software testing and test management industry, which is a sub-class of the software industry:

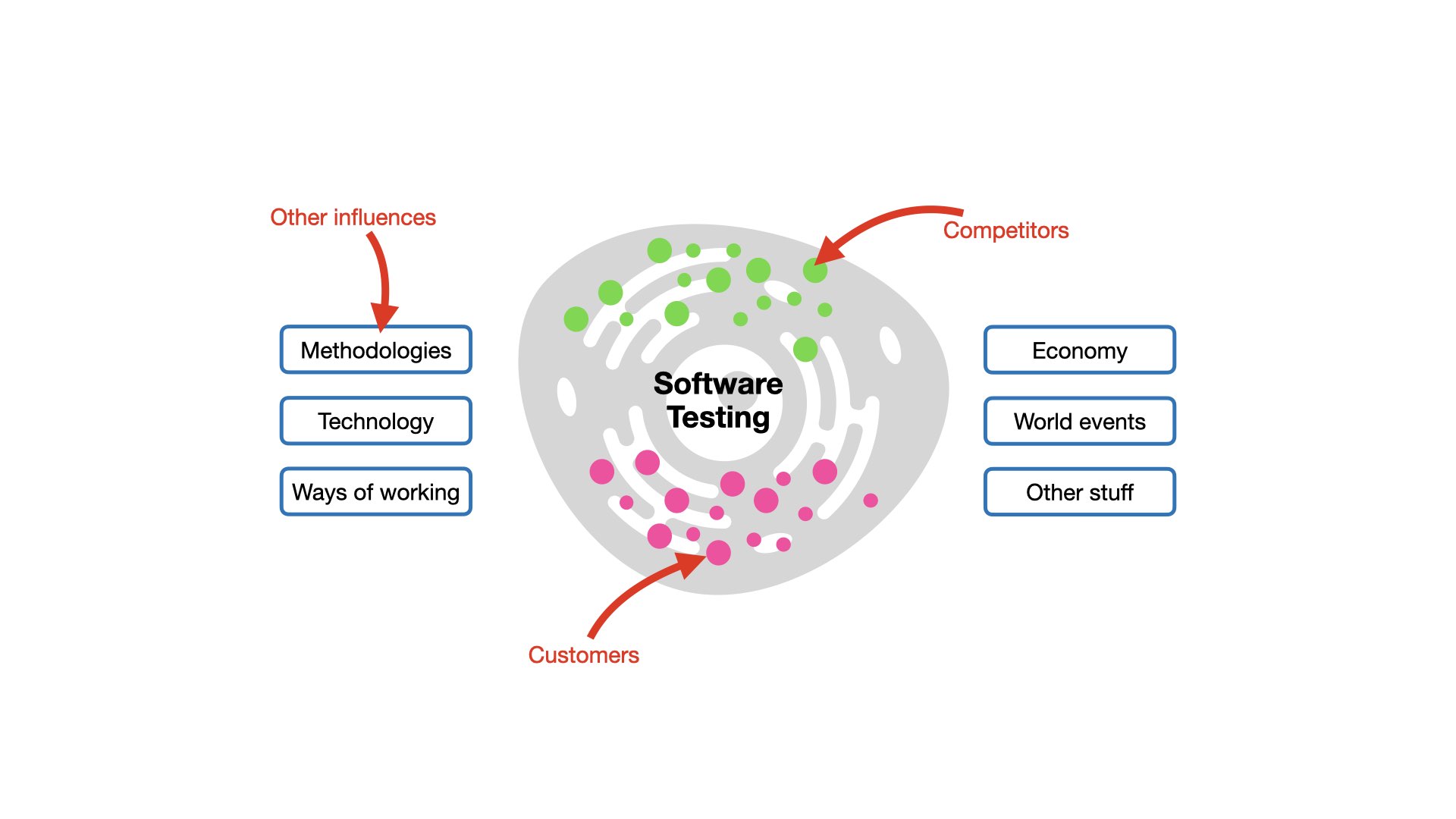

That industry (or marketplace in which I’m interested) is comprised of the set of customers and vendors that operate within it. The stuff that I am interested in are the additional factors which may influence activity within the marketplace or industry:

Clearly there could be a great number of other factors to take into account, but when modelling you have to stop somewhere, right?

From my model, it seems apparent that there are three main areas on which I can focus in order to build a picture of what’s happening in the marketplace in which I am interested:

- Customers

- Competitors

- Other influences

So, how do I find out relevant information about those areas?

Customers

For customers, there’s a simple but not easy answer… Talk to them!

You’d imagine that this would be easy enough. But the challenge I personally experience (and some other PM’s may identify with this) - is that it’s actually quite tough to pin them down to a phone call or a Zoom discussion. And having a one-on-one meeting with the customer is by far the most useful kind of interaction in my experience.

Other forms of customer interactions are usually by way of surveys, or may be in the form of feedback from other business departments (Customer Support, or Customer Success, or Sales typically) or from other situations such as conferences, meetups, webinars and the like.

Depending on the technology stack, there’s also the possibility of feedback from within the product itself, by way of user-tracking or other forms of monitoring.

So, signals from the customer (for me) look like this:

- Direct interactions (meetings on the phone or Zoom)

- Survey feedback (NPS or other survey types)

- Feedback from busines channels

- Event feedback

- In product monitoring

Competitors

The next big area to try and understand is what competitors are doing in the marketplace.

For me, this is even tricker and time-consuming than trying to elicit information from customers. Generally speaking, customers are pretty happy to tell you what they’re thinnking about and will often do so in no uncertain terms! Customers have a vested interest in improving the product, particularly if they have already parted with their cash.

Competitors on the other hand - not so much! They will actively try to hide information so as not to broadcast their product strategy and intent.

Fortunately, there are some relatively well establiushed mechanisms for analysing competitors in order to glean needed information. Some sources of useful data include the following:

- Industry publications

- Case studies

- Corporate info aggregation sites such as Owler, or Hoovers

- Press releases

- Company blogs

- The competitor product itself (through analysis or reverse engineering)

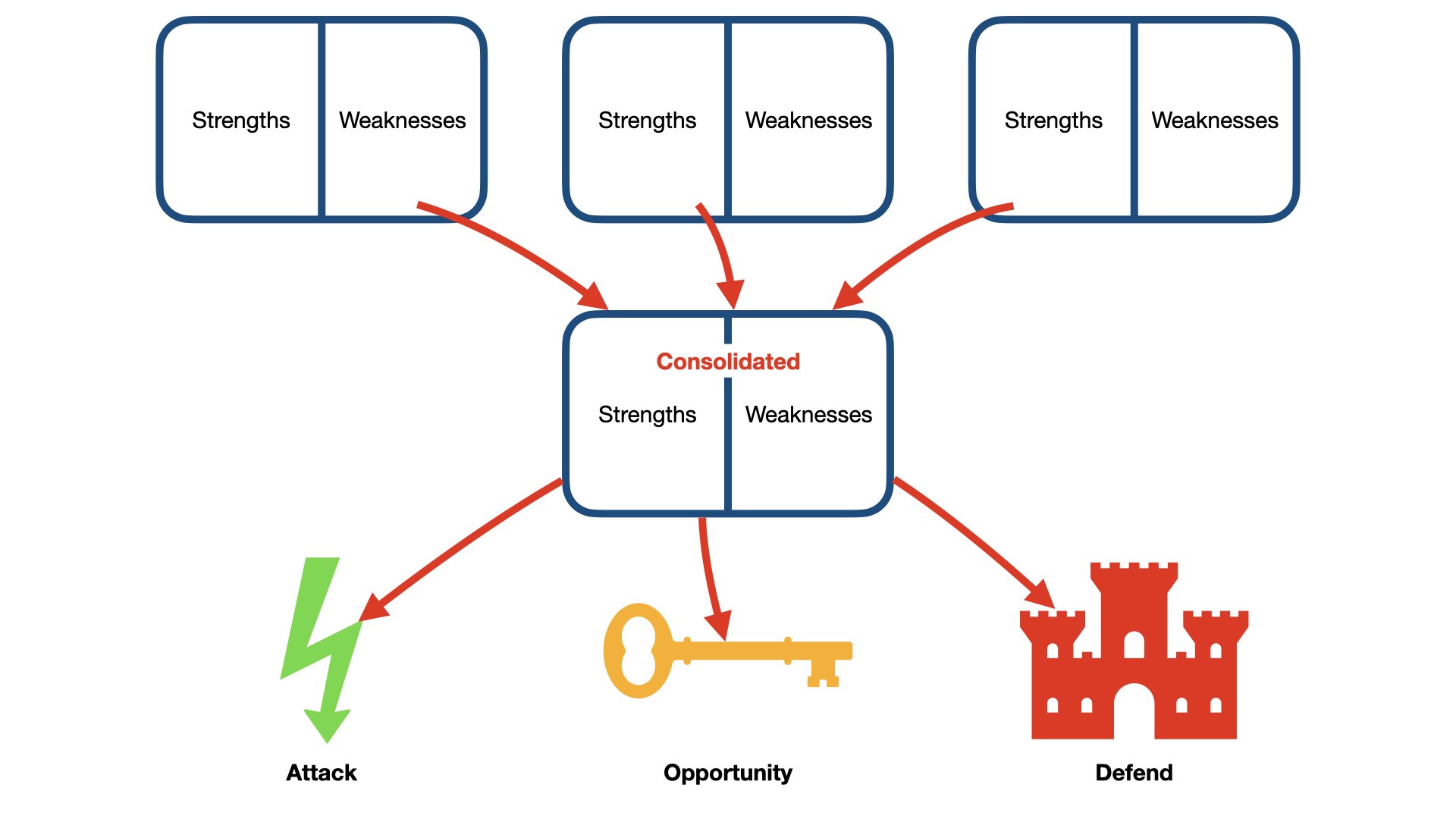

Once all that information has been gathered, you can start to turn it into a SWOT (Strengths, Weaknesses, Opportunities, Threats) model. There’s any number of resources on the interweb about what a SWOT is and how to do it, so I won’t dwell to much on it here. Except to mention that once you’ve gathered the necessary SWOT information about any competitors, it can be a good idea to consolidate it into a single view of all that data, so that you can use it formulate attack and defend vectors, as well as to identify potential opportunities (per Steven Haines PM Desktop Reference):

Which makes a lot of sense to me, hence reproducing the model.

Furthermore, Haines goes on to recommend an additional series of questions for delving deeper into competitor operations:

- How is the competitor company operated?

- How does the competitor actually produce their product?

- Via what channels does the competitor distribute their product?

- By what means does the competitor promote and sell their product?

- How does the competitor service and support their customers?

- What technologies are primarily used in the competitor product?

- What does the employee situation or culture look like for the competitor?

- What (if anything) are they communicating to any pertinent regulatory or government bodies?

Other influences

There’s a final area, other external influences, which warrants at least a little bit of attention. There’s not really too much I can say about this though, other than to pay attention to the world around your area of focus (remember the earlier narrowing down of that area) in as many ways as makes sense to you.

Speaking personally, I’m a bit of an information hoover, and will suck up information from anywhere I can find it. But as mentioned previously, that comes at the risk of overwhelm. The challenge is knowing when to stop. Which is what, I hope, the development and application of my model will help me with - once I’ve refined it some more.

Unfortunately, one thing it won’t help me with, is time.

Specifically, finding time to do all of the research implied by the various activities above, while still delivering on all the other PM activities expected from me…