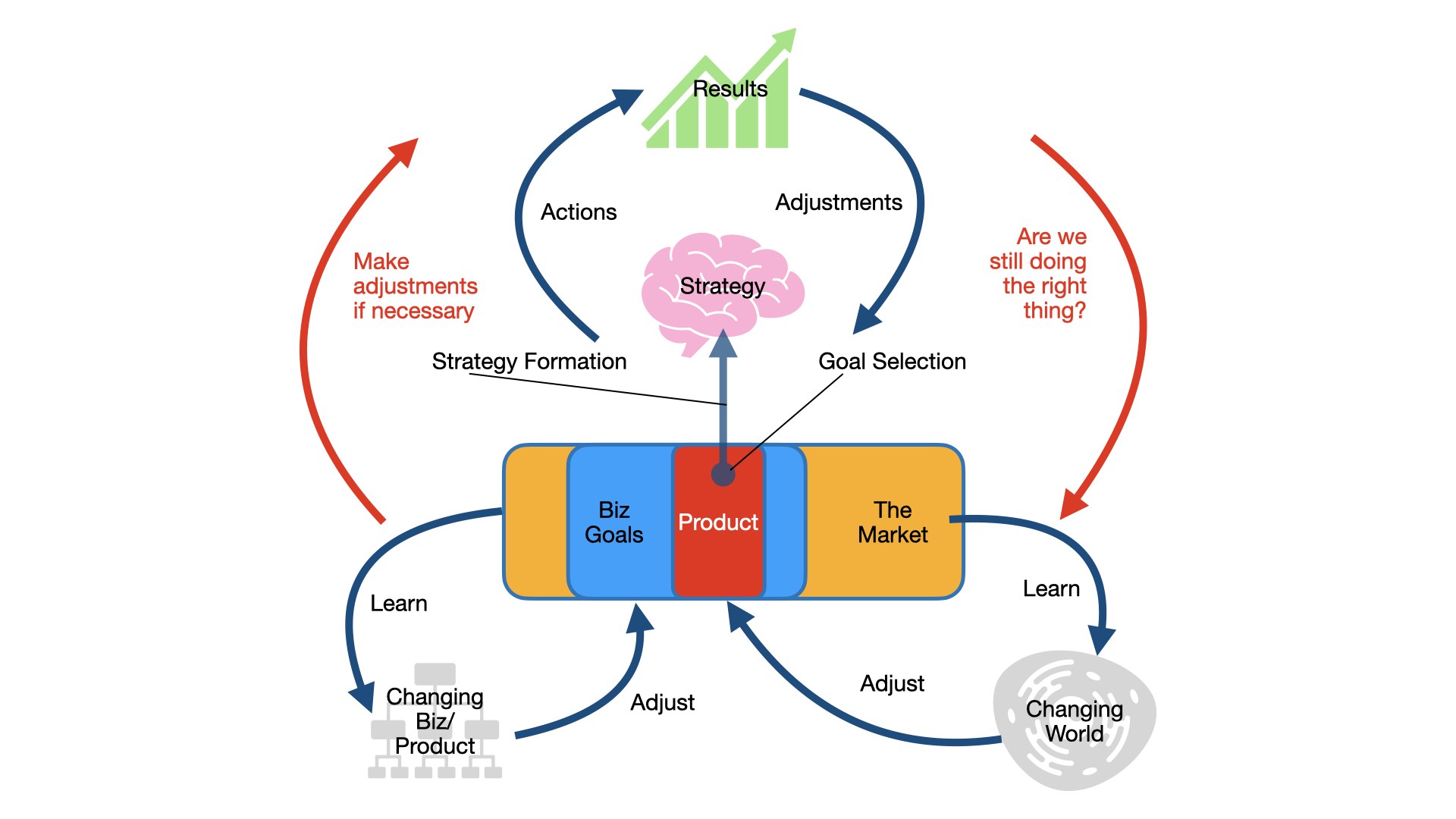

In my last post I presented a model for thinking about product strategy.

It’s a working model. I’m using it to refine my own understanding of the product management role in which I find myself currently, and to facilitate further, deeper learning and insights into:

- The various facets and responsibilities of the Product Management role

- Communication of PM tasks & responsibilities in a clear, visual, useful manner

- Identification of missing components through refinements to the model

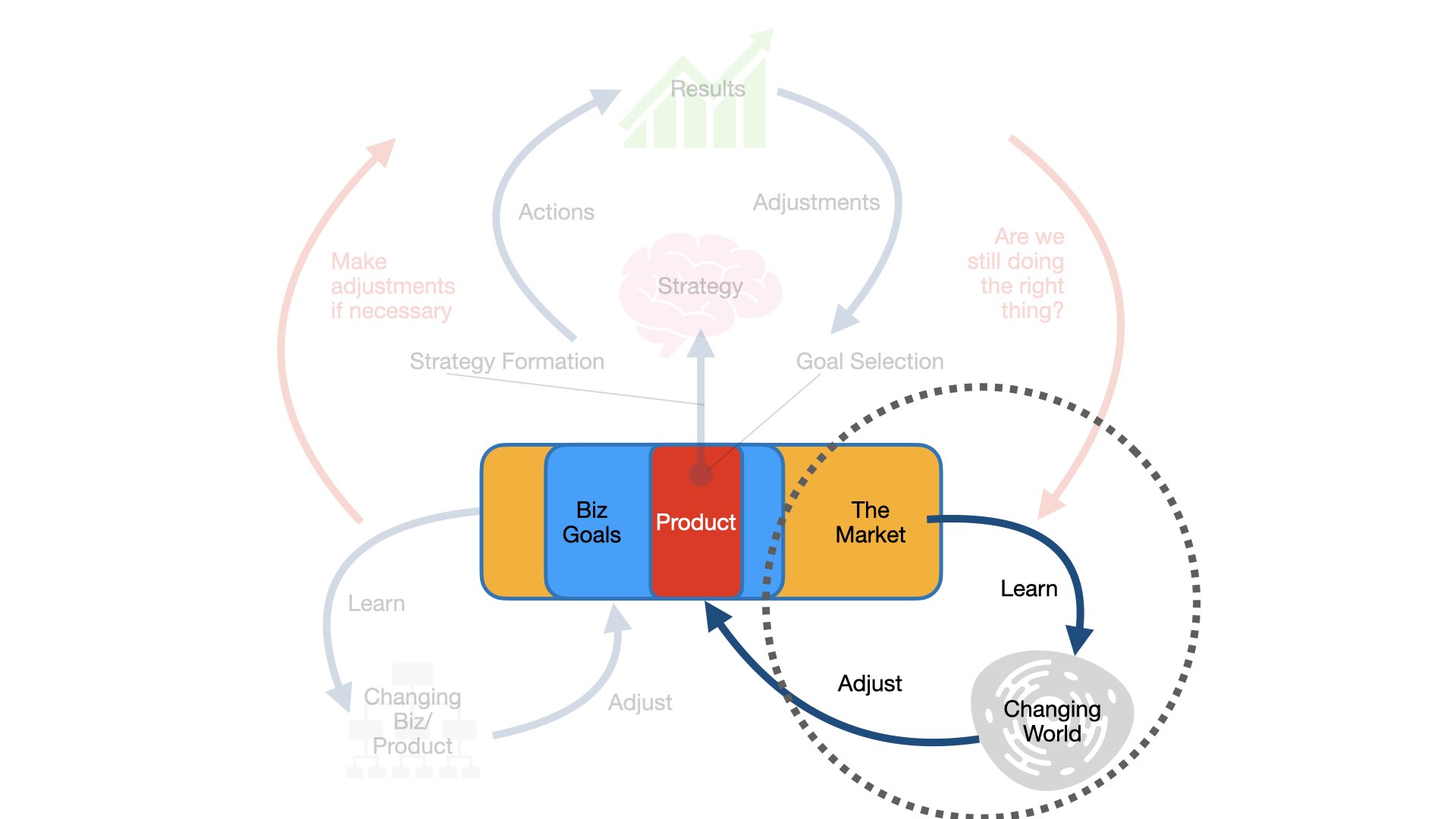

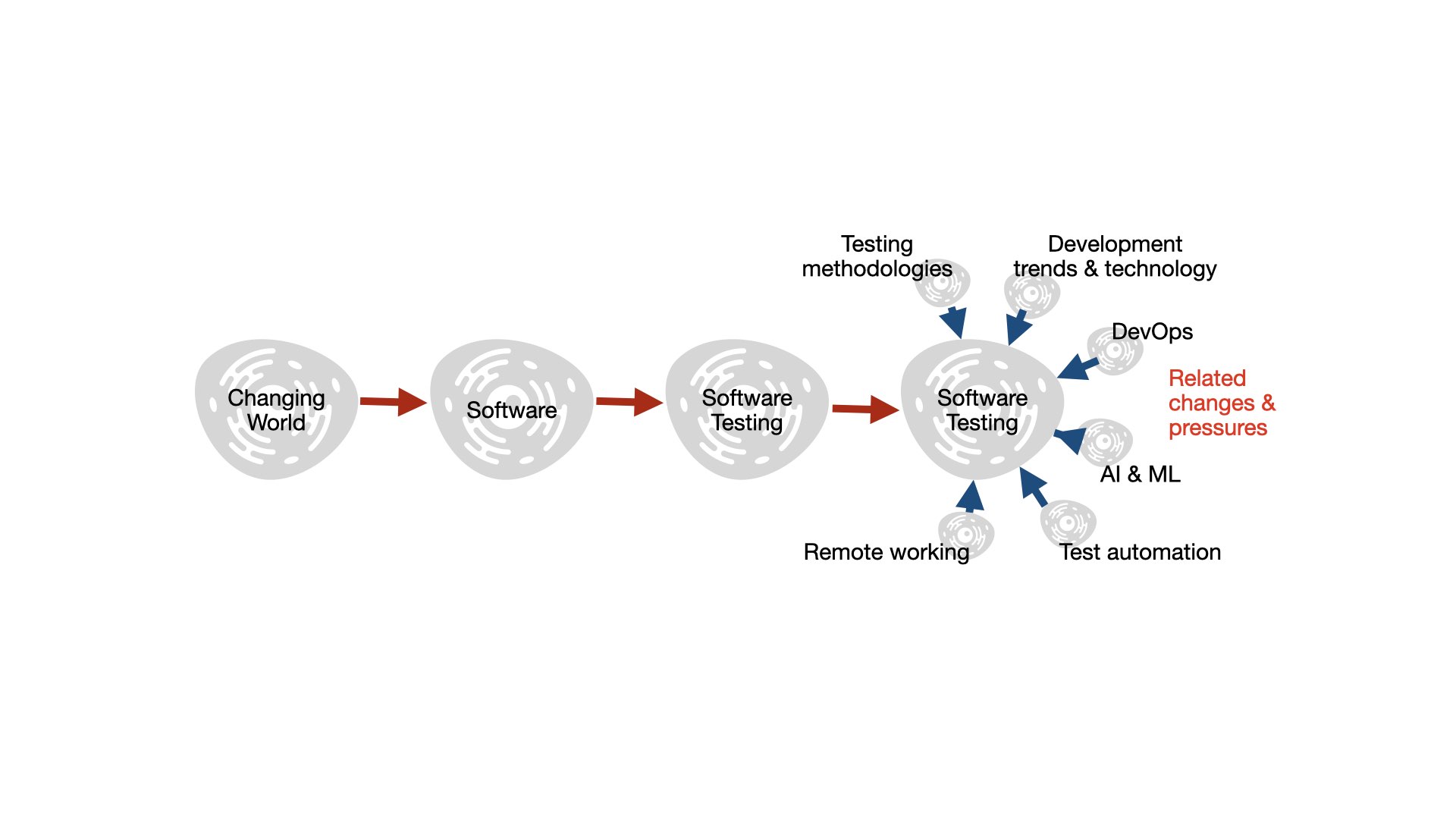

In this post, I’m thinking about one of the areas of Product Management that gives me quite the headache; developing a good understanding of the marketplace in which the product lives, and keeping that understanding up-to-date, such that it can be leveraged and communicated for strategic decision making. So, focusing on the bottom right of the existing model:

The changing world

Even just for this small part of the model, there’s lots to drill into. Questions I would want to try and answer while executing in this area of the PM role would be things like:

- How is the world changing? What is happening that I should or need to be aware of?

- How can those changes be analysed, measured, recorded?

- Which changes are important?

- What impact are those changes having on the world? Are the dimensions of the world changing?

- Are new players entering the world? Are players exiting it?

- How might all this information be represented in this or another more refined model?

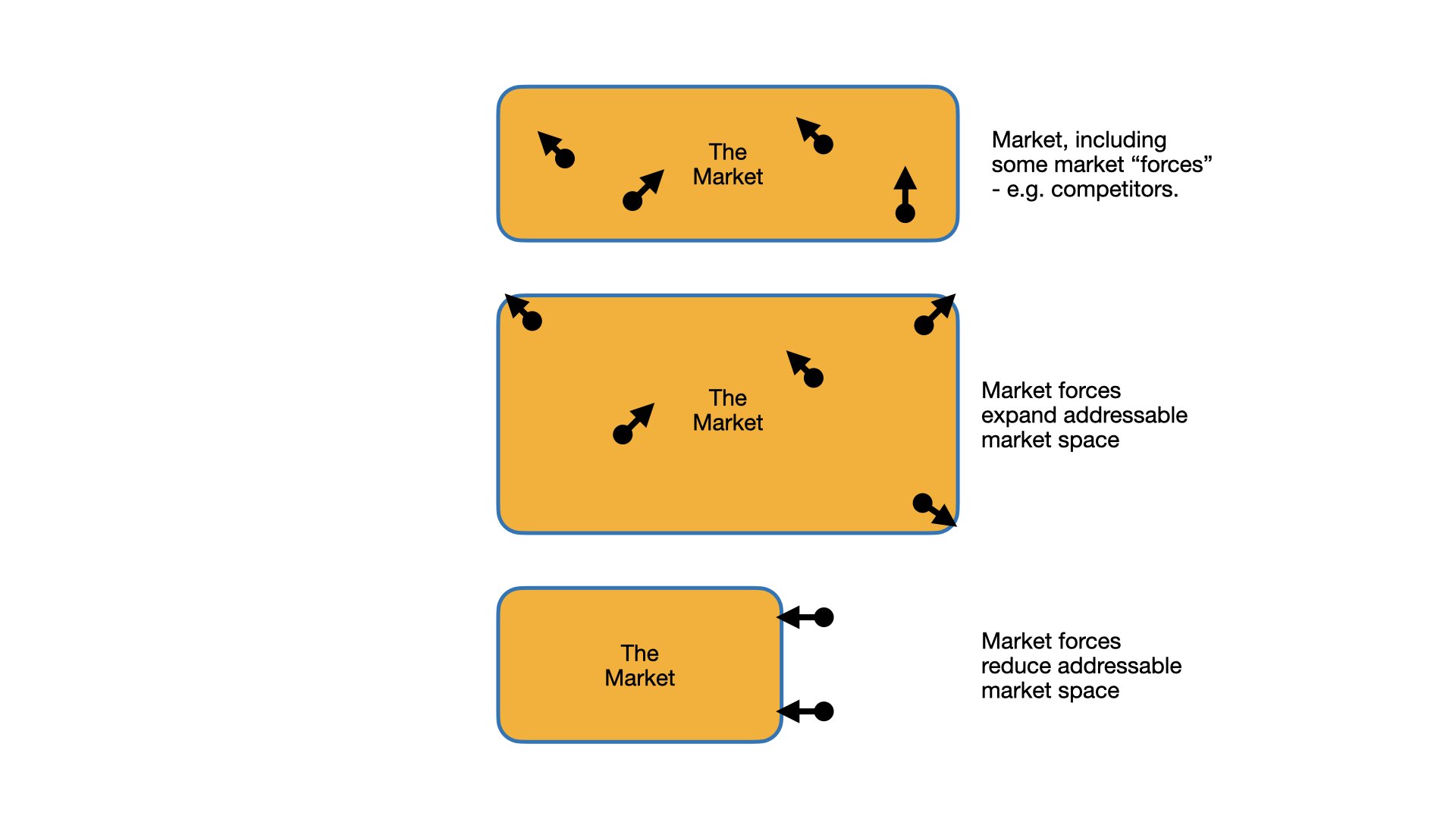

Some initial ideas I had for how this might be represented in the model were in the forms of nodes and vertices, like so:

Which is kind of simplistic, but in the context of the model it serves as a visual representation of what it is the PM is trying to understand when carrying out this type of research and analysis activity.

In my last post, I finished up with a bunch of questions:

- How do you determine what the changing space of the marketplace in which you operate actually looks like?

- Where are the boundaries?

- Where exactly does your product fit in?

- What process do you actually use to reflect upon your business and/or product in order to gauge what and whether adjustments are necessary?

- How does all that information feed into the formulation of a strategy which then itself has to be executed and adjusted within the context of your organisation, business processes and taking into account any constraints?

And it’s questions 1 & 2 that I’m really starting to address here. (I’ll come to the others in due course!) Specifically for this post, just the “Learn” arrow really. Turning that learning into actions will wait until another article.

Getting granular about your world

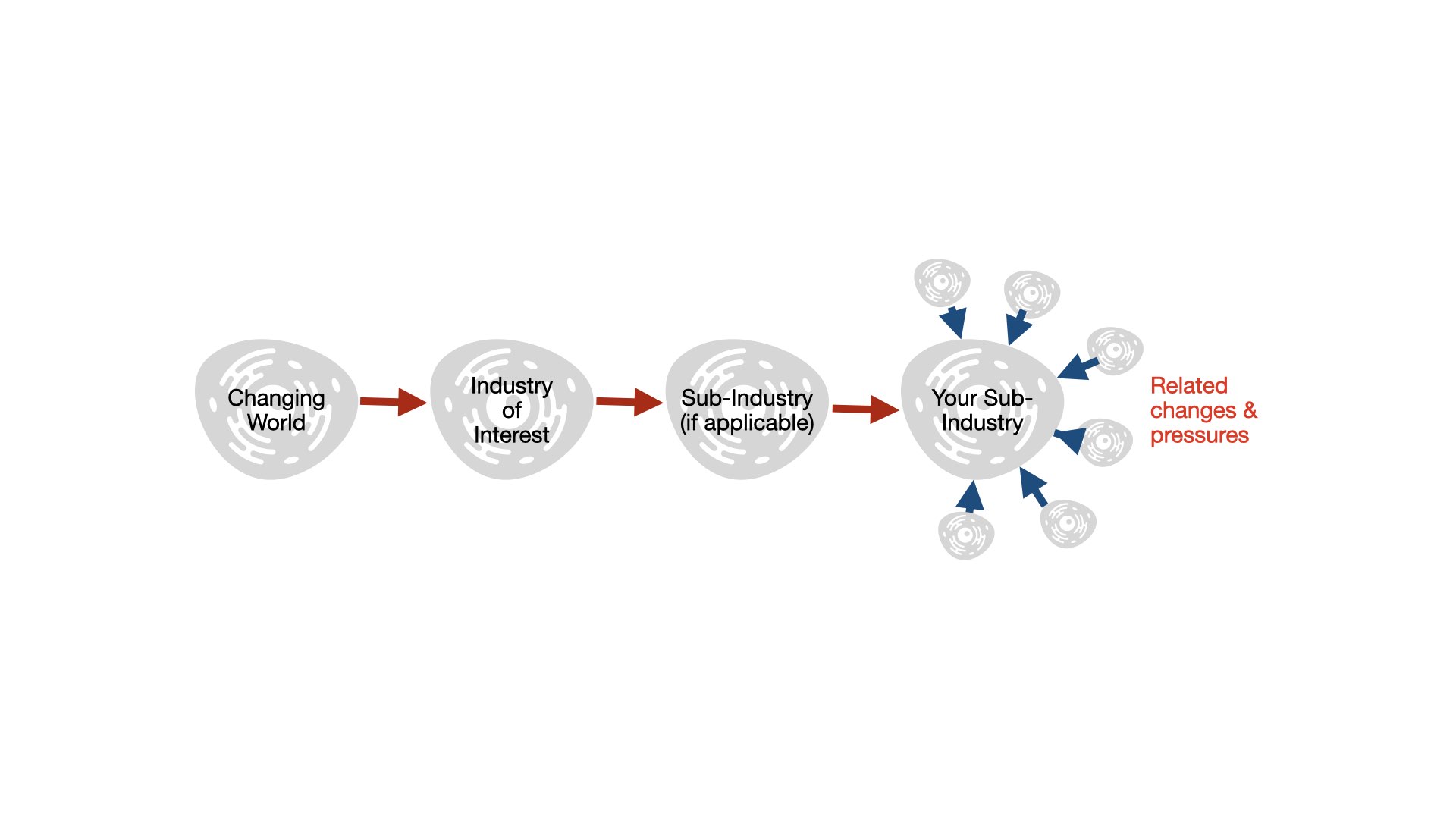

In the model, the thing I’m aiming to learn about is the “Changing World”. But really, the changing world is too big of an exercise. For the purposes of most PM jobs, a PM does not need to know about every detail of the changing world, and couldn’t even if they wanted to; the world is too big and too complex!

Really, we’re just interested in “the market” as it pertains to the product we’re managing and the the marketplace we’re operating in.

Definition time:

The market: a place where buyers and sellers interact.

To make any sense of the changes - to identify the relevant changes and how/why they are relevant to the context in which we’re operating, we need to be a bit more granular. We need to reduce the scope a bit - starting with the industry we’re actually interested in:

I gave that a try for my own context (TestRail - a test management SAAS product primarily targeting the software testing industry but also used for various other kinds of testing activities e.g. hardware) and came up with this as a first cut:

Now I’ve done that (refined the scope of the changes I’m interested in) - I can probably start to get a bit more traction with the work I actually need to do; gather data about the players in the marketplace and their activities, and figure out what, if any impact that is likely to have on our future product strategy.

Which raises a couple more questions to address:

- How do I find the data I’m interested in?

- How do I document/visualise/communicate that information meaningfully?

Getting hold of competitive information is simple but not easy. There’s plenty of sources to check for the kind of info we might be interested in to satisfy the demands of my model. This list, for example, comes from Haines’ Product Managers Desk Reference:

- Industry trade journals

- Business periodicals

- Internal reports from trade shows or events

- Trade associations

- Government reports

- Standards groups

- Financial reports

- Syndicated research

- Key word searches

- Field (primary) research

Out of that list, probably the one that I personally rely on the most is keyword searches; Google alerts me to news corresponding with a number of searches that I have setup ahead of time. Realistically for the rest of it, most research is done on the web these days.

Haines doesn’t mention another resource that is rather useful - namely blogging. Both by the testing community and by testing vendors.

Primary research is obviously incredibly useful as well, but comes with its own set of problems. Primarily, finding the time for it in the first place. And then making sure it’s done properly once you find the time. I’ll come back to this in a future post.

Capturing your insights

To wrap things up here, the final consideration is how to actually capture the information somewhere, somehow - such that it can be subsequently analysed and turned into actions, or used to adjust any existing strategy.

I don’t yet have a good answer for this. I’ve experimented with various documents, wikis, mindmaps, spreadsheets and databases, and have yet to find a single form of documentation that supports the process of gathering, analysing and synthesising market data such that it can easily and readily be made available to people that need it, when they need it. The key word here being easily. The information exists, and can be communicated on request; it just requires more effort than I would like. 😁

Anyway, a few methods that are worth exploring further are listed below:

- Use a table for observations and thoughts, in a spreadsheet or elsewhere - something like the following:

| Distant Past | Recent Past | Current | Future |

| | | | |

- A number of folk like and suggest Wardley Maps. I don’t yet have a strong opinion on this.

- Analyse using the PRESTO acronym (Political, Regulatory, Economic, Social/Societal, Technology, Other)

- Use other analytical tools, e.g. Michael Porters Five Forces model

- Get somebody else to do it for you (rely on external/contracted analysts)

Mostly I rely on #5 at present, because I don’t have time to do the work myself. If I did, I’d love to explore some of the other approaches some more - and would be very happy to hear from anyone who has explored these or other methods to hear how you’ve got on.

Ultimately once done though, you’re going to need to process whatever signals you’ve uncovered. But that’s an article for another time.